Your Go-To Source for Israeli Tech quantitative Research and Business Insights

Database Access

What can you do with it?

Unlock a comprehensive view of the Israeli tech ecosystem-access information on startups, investors, accelerators, multinational corporations, and entrepreneurs. Stay updated with the latest on financing deals, M&As, IPOs, new companies, and new investors.

9,950 NIS for annual access

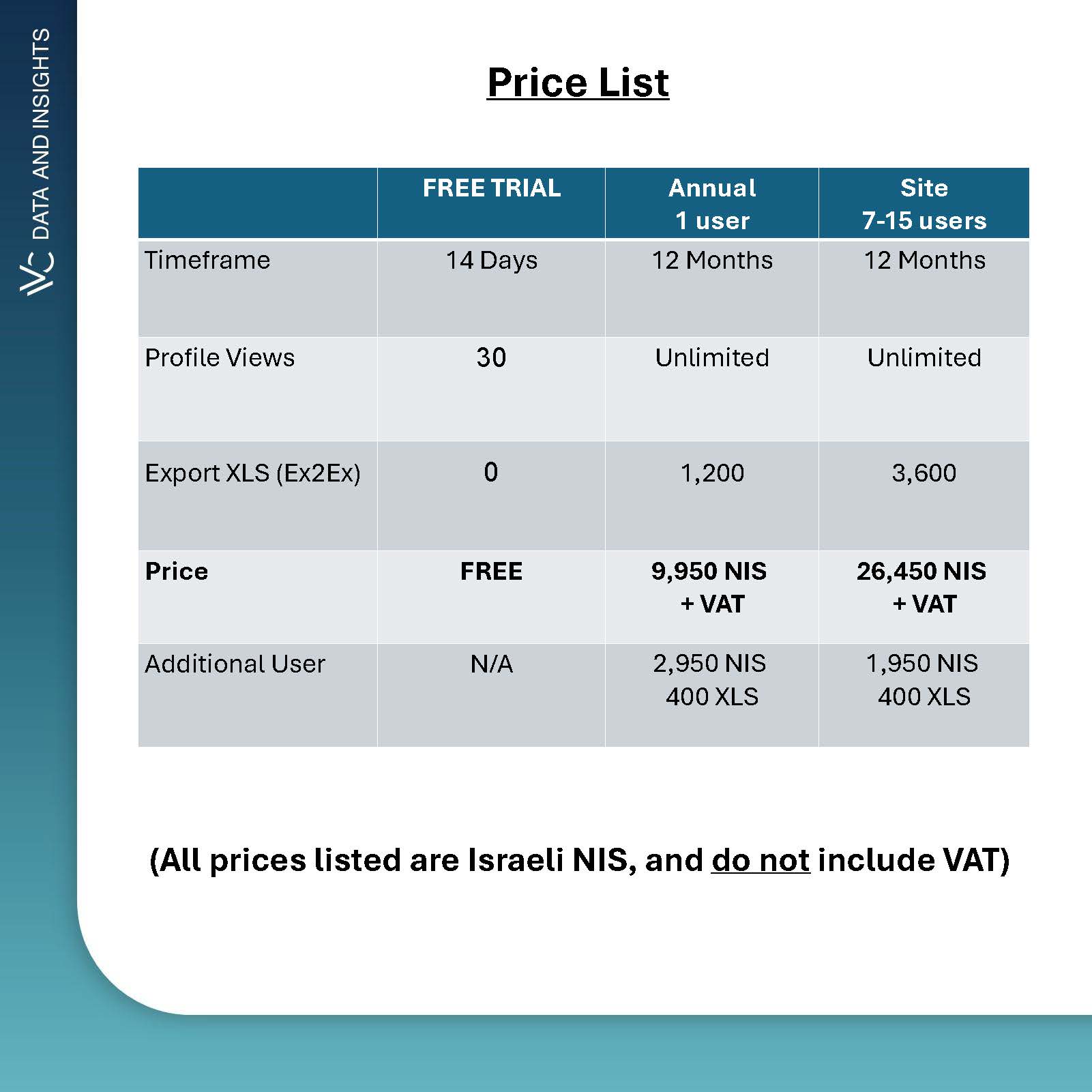

Pricing options

- Quarterly Membership Access: 3,500 NIS + VAT*

- Annual Membership Access: 9,950 NIS + VAT*

- Annual Membership Site License: 26,450 NIS + VAT*

- Click for more details and prices

Data Analytics

What can you do with it?

Empower your insights with IVC's Data Analytics dashboards, offering unparalleled access to detailed and aggregated data about financing rounds, exits, investment activity, and emerging trends.

The analytics suite ensures informed decisions

12,000 NIS for annual access

Data Feed

What can you do with it?

If you're an Israeli service provider, our data feed helps you make smarter, data-driven connections. Whether in HR, real estate, IT, legal, finance, or marketing

3,700 NIS for annual access

Available types of data exports are

- Newly added Technology Companies

- Newly added Financing Rounds

- Companies Seeking Capital

- Newly added Tech Investors

- Recently Ceased to Operate companies

- Newly Published Exits

Export-2-Excel

What can you do with it?

(*Available only for annual subscribers) Use the Advanced Search options and filters to create a list of entities and download the results into an Excel sheet.

7 NIS + VAT per line

Available types of data exports are

Customized BI Dashboards

What can you do with it?

Craft your customized data feed by defining your interest in companies, executives, tech verticals, and financial events. Choose specific data points and customize the display to ensure that relevant data and analytics are obtained.

Price per application

API Services

What can you do with it?

A web service suite that facilitates seamless integration of your information systems with the IVC-Online Database. The API provides access, connectivity, and a bridge between proprietary systems and IVC's database, ensuring effortless data exchange and synchronization.

Price per application

Customized Reports

What can you do with it?

Dive into the details, explore a specific tech sector, or discover particular investment activities; the Customized Reports are your key to data-based insights. Gain in-depth overviews of tech sectors and trends, reveal historic financial events, and access raw data for thorough research. The Customized Reports analyze market dynamics, track investment trends, and provide tailored intelligence for making informed decisions and staying ahead of the competition.

Price per application

X

- Contact Info

- Terms & Conditions

I.V.C invests efforts and knowledge to collect, assemble, arrange, and edit the data and information accessible through its Data Products, and, as such, owns the copyright in the content according to law.

The Materials are protected by applicable copyright, trademark, and other laws protecting intellectual property and related proprietary rights.

For more details, please visit https://www.ivc-online.com/Terms-Privacy

Read MoreClose

Copyright 2024 IVC Research Center LTD. All rights reserves

For similar insights and much more

We appreciate you contacting us.

We will get back to you soon.